Useful Tips and Tricks for Users Business Transactions

absolutely comprehensible

absolutely

With Finance in Business Central, you get a clear picture of your figures and ensure that your business transactions are traceable - even during the audit. 🧾 There are different functions helping you create informative reports, manage your finances efficiently and make informed data-based decisions.

Finance in Dynamics 365 Business Central: important Functions and Features

You can manage your assets in Dynamics 365 Business Central and, among other things, calculate depreciation, manage insurance, post transactions, keep track of maintenance costs and create reports.

You can manage your customers and vendors centrally, create invoices and record payments. You also have the option of tracking open customer entries. Interest and fees due can be calculated automatically. You can also easily remind your customers of payments due.

Charts of account play a central role in the organization and structuring of your financial accounting. They organize and classify your accounts according to certain criteria and define the relationships between the individual accounts. Your chart of account in Business Central can be adapted to the specific requirements and structures of your company.

You can create, manage and monitor budgets to analyze the financial performance of your company against defined targets.

Bank accounts can be integrated into the system so that there is an automatic reconciliation of bank transactions with the corresponding posting entries.

With the finance in Business Central you can manage transactions in different currencies - including currency conversion and exchange rate management.

You can define tax rules, create tax reports and manage tax payments to ensure your business is tax compliant.

Financial transactions between multiple companies within the same Business Central environment can be automated and optimized.

Business Central supports eXtensible Business Reporting Language (XBRL) - the international standard format for electronic reporting. Many financial authorities and regulatory authorities around the world require companies to file financial reports in XBRL format.

Payments from your customers via credit card payment systems or PayPal are directly transferred to the system.

The DATEV software can be integrated into Business Central, enabling a seamless transfer of accounting data such as charts of accounts, postings and documents between Dynamics 365 Business Central and DATEV.

There are various analysis tools and reporting options to help you gain insight into the financial health of your organization and make reliable business decisions. Microsoft Power BI is a flexible alternative to the reports that are integrated into Business Central. This is because you can drill down and adjust the visualization there. Some Power BI reports can also be embedded in Business Central without having to leave the system.

Your Benefits 💪

-

360° Overview of Success-critical Key Figures

Data from different departments is cross-linked so that you have an overview of key performance indicators at all times. This helps you to make informed business decisions and identify patterns and trends.

-

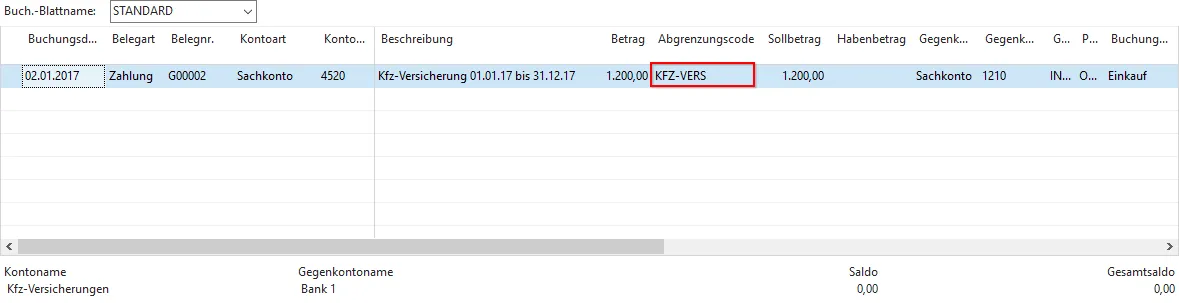

Automated Posting of Business Transactions

The posting of business transactions can be simplified with general rules, recurring postings and automated chargebacks. You also receive automatic recommendations from the system, for example to avoid reminder fees or to benefit from discounts.

-

Traceability of all your Transactions

The requirements of a financial system are met with Business Central’s simple traceability. All steps and decisions in the accounting process are clearly documented, so that a transaction can be traced from start to finish.

-

Data Integrity through Centralization

You can also increase your data integrity by centralizing your core financial data such as target and actual figures, foreign currencies and average values. Using a single posting process ensures automated totals and thus guarantees the continuous availability of data.

-

Compliance with international Financial Accounting Requirements

In addition, the finance also fulfills demanding international requirements. The system uses background checks to ensure that your transactions remain accurate, efficient and traceable. In addition, XBRL support ensures that you meet international standards.

More information

on the topic Finance

on the

Fully integrated

Fully integrated